If you’ve ever sent or received an international payment, chances are an MT103 SWIFT message was involved. This message type is the backbone of cross-border payments, enabling banks to transfer funds securely and efficiently across the globe. But what exactly is an MT103 message, and how does it work?

In this blog post, we’ll break down the MT103 SWIFT message in detail, explain the roles of all stakeholders involved, and provide real-life examples to help you understand how it processes payments. We’ll also include sample messages, diagrams, and an explanation of why it’s called correspondent banking. Let’s dive in!

Table of Contents

What Is MT103 SWIFT Message?

The MT103 is a standardized SWIFT message used for Single Customer Credit Transfers. It’s the most common message type for sending money from one bank account to another across borders. The MT103 contains all the necessary details for the payment, including:

- Sender’s and receiver’s account information

- Payment amount and currency

- Transaction reference numbers

- Instructions for the receiving bank

Think of the MT103 as a digital “payment order” that travels securely through the SWIFT network to ensure the money reaches the right destination.

Key Components of an MT103 Message

Here’s a breakdown of the key fields in an MT103 message:

| Field | Description |

|---|---|

| 20 | Sender’s reference number (e.g., invoice number or payment ID). |

| 23B | Bank operation code (e.g., “CRED” for credit transfer). |

| 32A | Value date, currency, and amount of the payment. |

| 50a | Sender’s account details (name, address, and account number). |

| 52a | Sender’s bank details (if different from the ordering institution). |

| 56a | Intermediary bank details (if applicable). |

| 57a | Beneficiary’s bank details. |

| 59a | Beneficiary’s account details (name, address, and account number). |

| 70 | Payment details (e.g., invoice reference or description of the transaction). |

| 71A | Charges (e.g., “BEN” for beneficiary pays charges). |

| 72 | Additional information for the receiving bank. |

Sample MT103 Message

Here’s an example of what an MT103 message might look like:

:20:1234567890

:23B:CRED

:32A:231015EUR50000,

:50a:/1234567890123456

John Doe

123 Main Street

New York, USA

:52a:BANKUS33XXX

:57a:DEUTDEFFXXX

:59a:/DE89370400440532013000

Jane Smith

456 Business Avenue

Berlin, Germany

:70:Invoice 789

:71A:BEN

:72:/ACC/Additional detailsExplanation of the Sample Message

- :20: Sender’s reference number (e.g., invoice number).

- :23B: Bank operation code (“CRED” for credit transfer).

- :32A: Value date (October 15, 2023), currency (EUR), and amount (€50,000).

- :50a: Sender’s account details (John Doe’s account in the U.S.).

- :52a: Sender’s bank (BANKUS33XXX).

- :57a: Beneficiary’s bank (DEUTDEFFXXX, Deutsche Bank in Germany).

- :59a: Beneficiary’s account details (Jane Smith’s account in Germany).

- :70: Payment details (e.g., “Invoice 789”).

- :71A: Charges (“BEN” means the beneficiary pays the fees).

- :72: Additional information for the receiving bank.

Stakeholders Involved in an MT103 Transaction

An MT103 transaction involves multiple stakeholders, each playing a critical role in ensuring the payment is processed correctly. Here’s who’s involved:

1. The Sender (Ordering Customer)

- The person or business initiating the payment.

- Provides payment instructions to their bank, including the beneficiary’s details and payment amount.

2. The Sender’s Bank (Ordering Institution)

- The bank that receives the payment instructions from the sender.

- Creates and sends the MT103 message to the beneficiary’s bank via the SWIFT network.

3. Intermediary Banks (if applicable)

- Banks that facilitate the transfer between the sender’s bank and the beneficiary’s bank.

- Often used when the two banks don’t have a direct relationship.

4. The Beneficiary’s Bank (Receiving Institution)

- The bank that receives the MT103 message and credits the beneficiary’s account.

- Verifies the payment details and ensures compliance with regulations.

5. The Beneficiary

- The person or business receiving the payment.

- Receives the funds in their account once the transaction is complete.

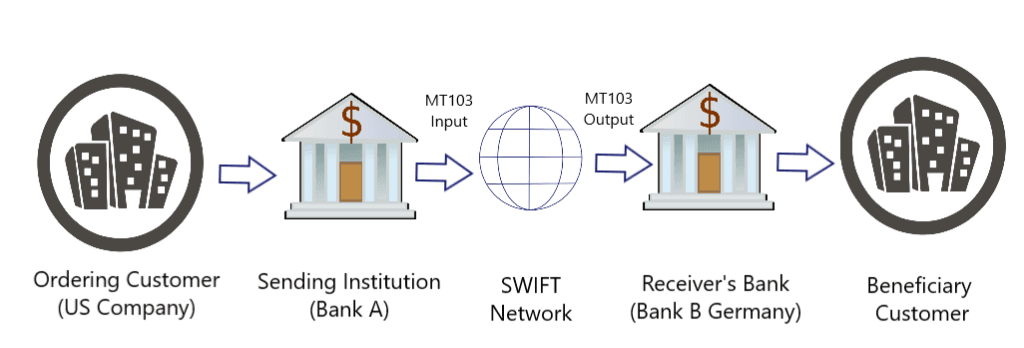

Why Is It Called Correspondent Banking?

In international payments, banks often don’t have direct relationships with every other bank in the world. Instead, they rely on correspondent banking to facilitate transactions. Here’s how it works:

- Correspondent Banks: These are intermediary banks that act as a bridge between the sender’s bank and the beneficiary’s bank.

- Nostro and Vostro Accounts: Correspondent banks maintain accounts with each other (e.g., Bank A holds a nostro account with Bank B, and Bank B holds a vostro account for Bank A).

- Payment Routing: When a payment is sent, it may pass through one or more correspondent banks before reaching the beneficiary’s bank.

Example of Correspondent Banking

- Bank A in the U.S. wants to send money to Bank B in Germany but doesn’t have a direct relationship.

- Bank A uses Bank C (a correspondent bank) to facilitate the transfer.

- Bank C holds accounts with both Bank A and Bank B, enabling the payment to be routed efficiently.

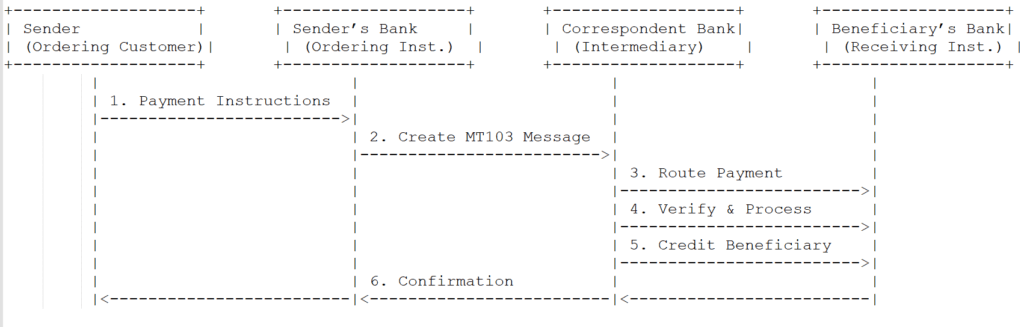

How an MT103 Message Works: Step-by-Step Process

Let’s walk through the process of sending an international payment using an MT103 message, with a real-life example.

Real-Life Example: Sending Payment to a Supplier

Imagine you’re a business owner in the U.S. who needs to pay a supplier in Germany €50,000 for goods. Here’s how the process works:

- Step 1: Initiation

- You provide your bank with the supplier’s details, including their bank account number (IBAN), bank name, and the payment amount (€50,000).

- You also include a payment reference (e.g., invoice number) and specify who pays the fees (e.g., “BEN” for beneficiary).

- Step 2: MT103 Message Creation

- Your bank creates an MT103 message with all the required details:

- Sender’s account details (your account)

- Beneficiary’s account details (supplier’s account)

- Payment amount (€50,000)

- Payment reference (invoice number)

- Instructions for the receiving bank

- Step 3: Transmission via SWIFT

- Your bank sends the MT103 message securely through the SWIFT network to the supplier’s bank in Germany.

- Step 4: Receipt and Verification

- The supplier’s bank receives the MT103 message and verifies the details.

- They check for compliance with regulations and ensure the beneficiary’s account is valid.

- Step 5: Payment Execution

- The supplier’s bank credits the supplier’s account with €50,000.

- The supplier receives a notification of the incoming payment.

- Step 6: Confirmation

- Your bank receives confirmation that the payment has been successfully processed.

- You receive a acknowledgment (Ack/Nack) notification that the payment is complete or if there is any error.

- In case there is error the transaction is cancelled and return message is sent back. This will be discussed in next posts.

Diagram: MT103 Payment Flow with Correspondent Banking

MT103 message example, the detailed explanation is provided in next post, with all different scenarios.

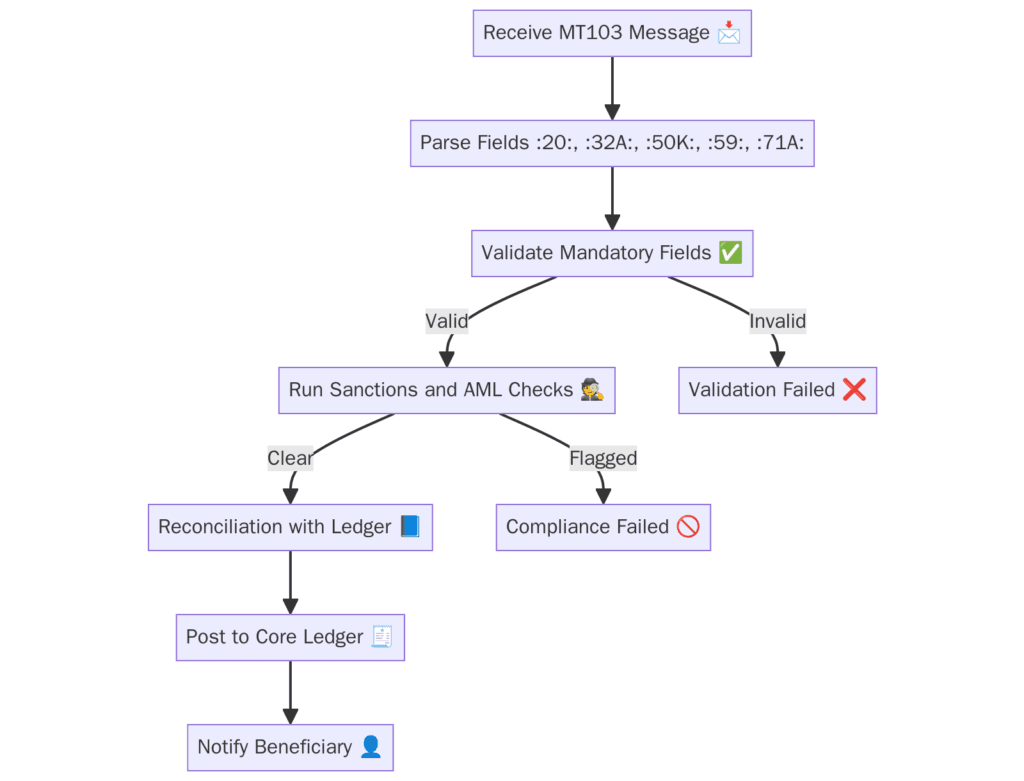

Flow Chart For Compliance Check in MT103:

This flowchart shows a simple representation of the flow of MT103 and how compliance check works.

Compliance check is checking the important details like country and name of the customer matching any flagged entity or blacklisted entity. On validation failed scenarios different banks can have different processes to take action on such transactions.

Some can proceed after next step of validations with transaction or they can return the transaction back.

Why Is the MT103 Message Important?

- Global Standardization: The MT103 follows a universal format, ensuring that banks worldwide can process payments without confusion.

- Security: SWIFT’s encryption and authentication protocols protect sensitive payment data.

- Efficiency: The standardized format reduces errors and speeds up transaction processing.

- Traceability: Each MT103 message includes unique reference numbers, making it easy to track payments.

Real-Life Challenges with MT103 Messages

While MT103 messages are highly efficient, they’re not without challenges:

- Delays: Cross-border payments can take 1-3 business days due to intermediary banks and time zone differences.

- Fees: Multiple banks may charge fees, increasing the cost of the transaction.

- Errors: Incorrect beneficiary details can delay or even block the payment.

Conclusion

The MT103 SWIFT message is a critical tool for international payments, enabling businesses and individuals to transfer funds securely and efficiently across borders. By understanding how it works, the roles of all stakeholders, and the concept of correspondent banking, you can navigate the complexities of cross-border payments with confidence.

Whether you’re a business owner paying overseas suppliers or an individual sending money to family abroad, the MT103 message ensures your payment reaches its destination safely.

In next post, we will discuss about different scenarios in MT103 transactions.