Table of Contents

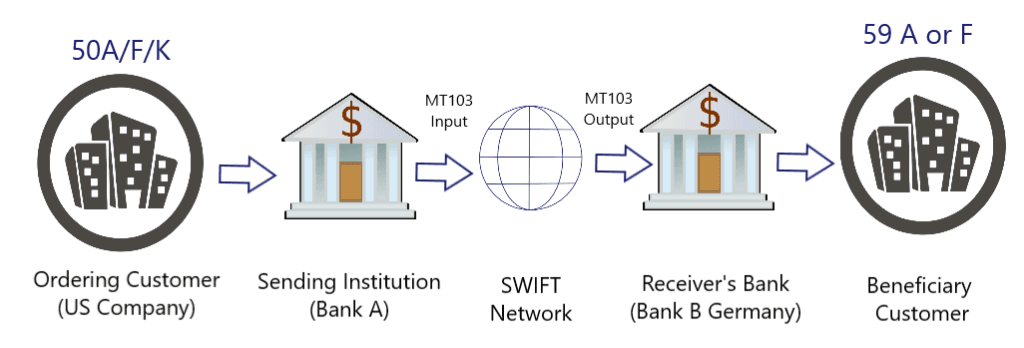

Scenario 1: Simple Cross-Border Payment

Description: A company in the United States needs to pay a supplier in Germany for goods received. The payment is made via an MT103 message.

Flow:

- Initiation: The US company instructs its bank (Bank A) to send a payment to the German supplier’s bank (Bank B).

- MT103 Creation: Bank A creates an MT103 message with all necessary details.

- Transmission: The MT103 message is sent via the SWIFT network to Bank B.

- Processing: Bank B receives the MT103, processes the payment, and credits the supplier’s account.

Diagram 1: Simple Cross-Border Payment Flow

Example MT103 Message:

{1:F01BANKUS33XXXX1234567890}{2:O1031200190103BANKDEFFXXXX5432101234N}{3:......}{4:

:20:REF123456789

:23B:CRED

:32A:231012USD100000,

:50K:/123456789

ABC Company Inc.

123 Main Street

New York, NY 10001

USA

:52A:BANKUS33XXX

:57A:BANKDEFFXXX

:59:/DE987654321

Supplier GmbH

456 Business Avenue

Berlin, 10115

Germany

:70:INVOICE 12345

:71A:SHA}{5:...}

Explanation:

- :20: Sender’s reference (

REF123456789). - :32A: Value date (October 12, 2023), currency (USD), and amount (

100,000 USD). - :50K: Ordering customer (US company).

- :52A: Sending institution (

BANKUS33XXX). - :57A: Receiver’s bank (

BANKDEFFXXX). - :59: Beneficiary customer (German supplier).

- :70: Remittance information (invoice reference).

- :71A: Charges (shared between sender and receiver).

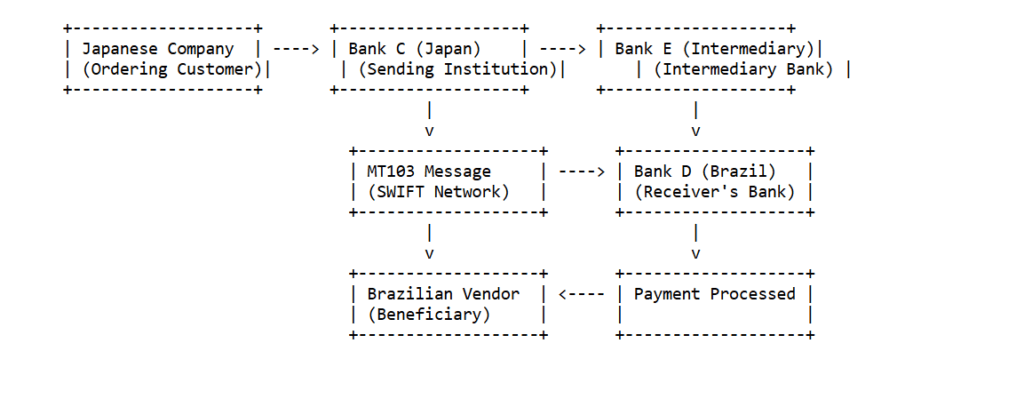

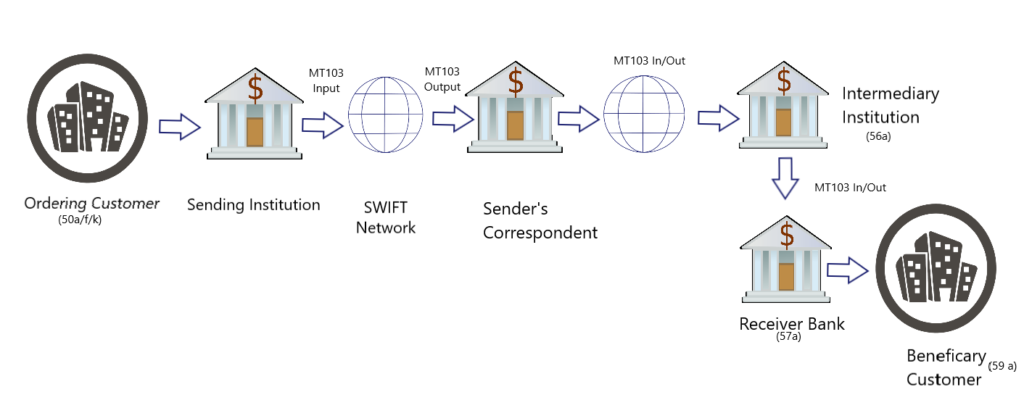

Scenario 2: Payment with Intermediary Bank

Description: A company in Japan needs to pay a vendor in Brazil, but the two banks do not have a direct relationship. An intermediary bank is used to facilitate the transaction.

Flow:

- Initiation: The Japanese company instructs its bank (Bank C) to send a payment to the Brazilian vendor’s bank (Bank D).

- Intermediary Bank: Since Bank C and Bank D do not have a direct relationship, Bank C sends the MT103 to an intermediary bank (Bank E) that has relationships with both banks.

- MT103 Forwarding: Bank E forwards the MT103 to Bank D.

- Processing: Bank D receives the MT103, processes the payment, and credits the vendor’s account.

Diagram 2: Payment with Intermediary Bank Flow

Picture representation of the flow above.

Example MT103 Message:

{1:F01BANKJPJTXXXX1234567890}{2:O1031200190103BANKBRSPXXXX5432101234N}{3:......}{4:

:20:REF987654321

:23B:CRED

:32A:231012JPY5000000,

:50K:/987654321

XYZ Corporation

789 Business Road

Tokyo, 100-0001

Japan

:52A:BANKJPJTXXX

:56A:INTERMEDBANK

:57A:BANKBRSPXXX

:59:/BR123456789

Vendor Ltda.

123 Vendor Street

Sao Paulo, 01000-000

Brazil

:70:INVOICE 67890

:71A:SHA}{5:...}

Explanation:

- :20: Sender’s reference (

REF987654321). - :32A: Value date (October 12, 2023), currency (JPY), and amount (

5,000,000 JPY). - :50K: Ordering customer (Japanese company).

- :52A: Sending institution (

BANKJPJTXXX). - :56A: Intermediary bank (

INTERMEDBANK). - :57A: Receiver’s bank (

BANKBRSPXXX). - :59: Beneficiary customer (Brazilian vendor).

- :70: Remittance information (invoice reference).

- :71A: Charges (shared between sender and receiver).

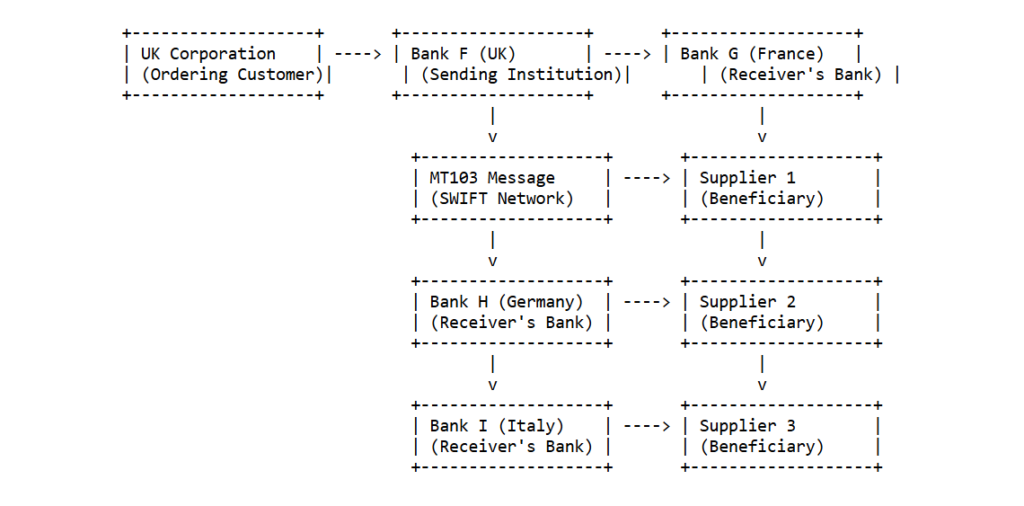

Scenario 3: Payment with Multiple Beneficiaries

Description: A corporation in the UK needs to pay multiple suppliers in different countries using a single MT103 message.

Flow:

- Initiation: The UK corporation instructs its bank (Bank F) to send payments to multiple suppliers.

- MT103 Creation: Bank F creates an MT103 message with multiple beneficiary details.

- Transmission: The MT103 message is sent via the SWIFT network to the respective banks of each supplier.

- Processing: Each bank receives the MT103, processes the payment, and credits the respective supplier’s account.

Diagram 3: Payment with Multiple Beneficiaries Flow

Example MT103 Message:

{1:F01BANKGB22XXXX1234567890}{2:O1031200190103BANKFRPPXXXX5432101234N}{3:......}{4:

:20:REF112233445

:23B:CRED

:32A:231012GBP25000,

:50K:/112233445

UK Corporation Ltd.

456 Corporate Avenue

London, EC1A 1BB

United Kingdom

:52A:BANKGB22XXX

:57A:BANKFRPPXXX

:59:/FR123456789

Supplier 1

123 Rue de Commerce

Paris, 75001

France

:70:INVOICE 11111

:71A:SHA

-}

{1:F01BANKGB22XXXX1234567890}{2:O1031200190103BANKDEFFXXXX5432101234N}

:20:REF112233446

:23B:CRED

:32A:231012GBP15000,

:50K:/112233445

UK Corporation Ltd.

456 Corporate Avenue

London, EC1A 1BB

United Kingdom

:52A:BANKGB22XXX

:57A:BANKDEFFXXX

:59:/DE987654321

Supplier 2

456 Business Avenue

Berlin, 10115

Germany

:70:INVOICE 22222

:71A:SHA}{5:...}

Explanation:

- Two separate MT103 messages are sent for each beneficiary.

- Each message has a unique sender’s reference (

:20:), beneficiary details (:59:), and invoice reference (:70:).

Scenario 4: Payment with Currency Conversion

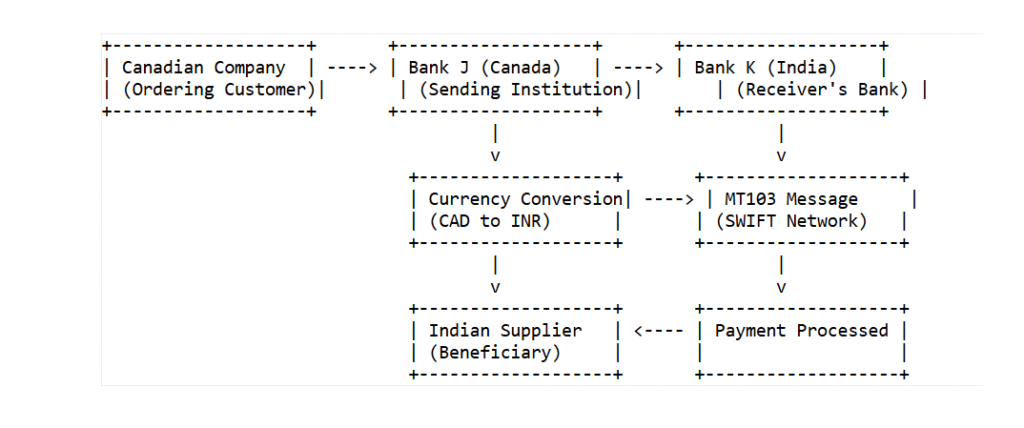

Description: A company in Canada needs to pay a supplier in India, but the payment needs to be converted from CAD to INR.

Flow:

- Initiation: The Canadian company instructs its bank (Bank J) to send a payment in CAD to the Indian supplier’s bank (Bank K).

- Currency Conversion: Bank J converts the CAD amount to INR using the current exchange rate.

- MT103 Creation: Bank J creates an MT103 message with the converted INR amount.

- Transmission: The MT103 message is sent via the SWIFT network to Bank K.

- Processing: Bank K receives the MT103, processes the payment in INR, and credits the supplier’s account.

Diagram 4: Payment with Currency Conversion Flow

Example MT103 Message:

{1:F01BANKCA33XXXX1234567890}{2:O1031200190103BANKINBBXXXX5432101234N}{3:......}{4:

:20:REF556677889

:23B:CRED

:32A:231012INR6500000,

:50K:/556677889

Canadian Company Ltd.

789 Maple Street

Toronto, ON M5H 2N2

Canada

:52A:BANKCA33XXX

:57A:BANKINBBXXX

:59:/IN123456789

Indian Supplier Pvt. Ltd.

123 Trade Road

Mumbai, 400001

India

:70:INVOICE 33333

:71A:SHA

:72:/EXCH/CADINR/1CAD=65INR}{5:...}

Explanation:

- :32A: Value date (October 12, 2023), currency (INR), and amount (

6,500,000 INR). - :72: Additional information about the currency conversion rate (

1 CAD = 65 INR).

Conclusion

The MT103 message is a vital tool in the global financial system, enabling secure and efficient cross-border payments. Understanding its structure and the various scenarios in which it is used can help businesses and financial institutions navigate the complexities of international transactions. Whether it’s a simple payment, a transaction involving an intermediary bank, or a payment requiring currency conversion, the MT103 ensures that funds are transferred accurately and reliably.

By visualizing these scenarios with diagrams, we can better appreciate the flow of information and funds, making it easier to understand the role of the MT103 in international banking. As global trade continues to grow, the importance of standardized payment messages like the MT103 will only increase, ensuring that businesses can operate seamlessly across borders.