Have you ever wondered what happens behind the scenes when you swipe your card or click “Pay Now” online? It might seem like magic, but there’s a lot going on in those few seconds it takes for your payment to go through. Payment processing is the invisible engine that powers every transaction, ensuring your money gets where it needs to go securely and efficiently. In this section, we’ll break down how payment processing works, who’s involved, and what happens at each step of the journey.

Table of Contents

3.1 How Payment Processing Works

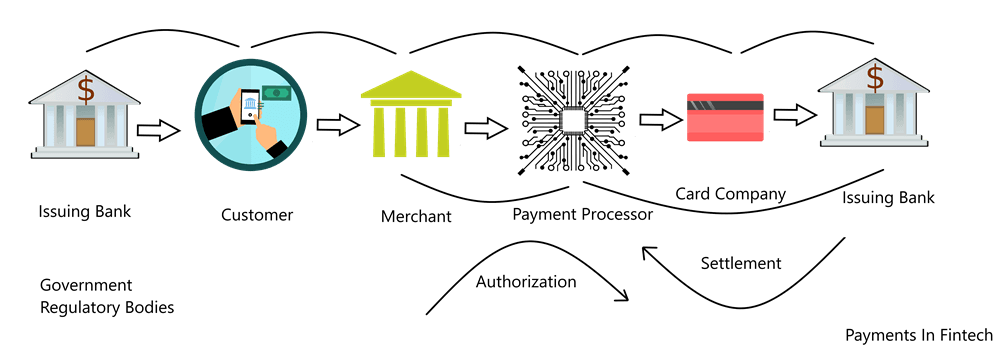

Payment processing is the series of steps that occur when a payment is made, whether it’s online, in-store, or via a mobile app. It involves multiple players working together to authorize, clear, and settle the transaction. Here’s a simplified overview of the process:

- Initiation: The customer initiates a payment by swiping a card, entering card details online, or using a mobile wallet.

- Authorization: The payment details are sent to the relevant parties to verify the transaction.

- Clearing: The transaction details are shared between the banks and payment networks.

- Settlement: Funds are transferred from the customer’s bank to the merchant’s bank.

While this might sound straightforward, each step involves complex systems and technologies to ensure everything runs smoothly.

3.2 Key Components of Payment Processing

To understand payment processing, it’s important to know the key players involved. Here’s a breakdown of who does what:

- Customer (Cardholder): The person making the payment using a credit card, debit card, or other payment method.

- Merchant: The business or individual receiving the payment for goods or services.

- Payment Gateway: The technology that captures and transmits payment data from the customer to the payment processor. For online transactions, this is often a virtual terminal.

- Payment Processor: The company that handles the transaction, acting as a middleman between the merchant, banks, and card networks.

- Acquiring Bank (Merchant Bank): The bank that holds the merchant’s account and receives the funds from the transaction.

- Issuing Bank (Cardholder’s Bank): The bank that issued the customer’s credit or debit card. It’s responsible for approving or declining the transaction.

- Card Networks: Companies like Visa, Mastercard, American Express, and Discover that provide the infrastructure for card-based payments. They set the rules and standards for transactions.

3.3 Payment Lifecycle: Authorization, Clearing, and Settlement

Let’s dive deeper into the three main stages of payment processing: authorization, clearing, and settlement.

1. Authorization

Authorization is the first step in the payment lifecycle. It’s all about verifying that the transaction can go through. Here’s how it works:

- The customer initiates a payment by swiping their card, tapping their phone, or entering card details online.

- The payment gateway captures the transaction details (e.g., card number, amount, and merchant information) and sends them to the payment processor.

- The payment processor forwards the details to the relevant card network (e.g., Visa or Mastercard).

- The card network sends the information to the issuing bank (the customer’s bank) for approval.

- The issuing bank checks the customer’s account to ensure they have sufficient funds or credit. It also verifies that the transaction isn’t flagged for fraud.

- If everything checks out, the issuing bank approves the transaction and sends an authorization code back through the card network and payment processor to the merchant.

- The merchant receives the authorization and completes the sale.

This entire process typically takes just a few seconds. If the transaction is declined, the customer will be notified, and they’ll need to use another payment method.

2. Clearing

Once a transaction is authorized, it moves to the clearing stage. This is where the details of the transaction are shared between the banks and card networks to prepare for settlement. Here’s what happens:

- At the end of the business day, the merchant batches all authorized transactions and sends them to the acquiring bank.

- The acquiring bank forwards the batch to the relevant card networks.

- The card networks process the transactions and send the details to the issuing banks.

- The issuing banks verify the transactions and prepare to transfer the funds.

Clearing ensures that all parties agree on the details of the transaction before money changes hands.

3. Settlement

Settlement is the final step in the payment lifecycle, where funds are transferred from the customer’s bank to the merchant’s bank. Here’s how it works:

- The issuing bank transfers the funds for the authorized transactions to the card networks.

- The card networks deduct their fees and forward the remaining funds to the acquiring bank.

- The acquiring bank deposits the funds into the merchant’s account, minus any processing fees.

- The merchant receives the payment, and the transaction is complete.

Settlement usually takes 1-3 business days, depending on the banks and payment networks involved.

3.4 Fees in Payment Processing

Payment processing isn’t free—there are fees at every stage of the process. Here’s a breakdown of the most common fees:

- Interchange Fees: These are paid by the acquiring bank to the issuing bank for each transaction. They’re typically a percentage of the transaction amount plus a flat fee.

- Assessment Fees: These are paid to the card networks (e.g., Visa or Mastercard) for using their infrastructure.

- Processing Fees: These are charged by the payment processor for handling the transaction. They may include a flat fee per transaction or a percentage of the transaction amount.

- Merchant Fees: These are the total fees paid by the merchant, including interchange, assessment, and processing fees.

The exact fees depend on factors like the type of card used, the size of the transaction, and the merchant’s agreement with their payment processor.

3.5 Challenges in Payment Processing

While payment processing is designed to be seamless, it’s not without its challenges. Here are some common issues:

- Fraud: Payment fraud is a major concern for both customers and merchants. Fraudsters use stolen card details or fake identities to make unauthorized transactions. To combat this, payment processors use advanced security measures like encryption, tokenization, and fraud detection algorithms.

- Chargebacks: A chargeback occurs when a customer disputes a transaction and requests a refund from their bank. Chargebacks can be costly for merchants, as they often result in lost revenue and additional fees.

- Declined Transactions: Transactions can be declined for various reasons, such as insufficient funds, incorrect card details, or suspected fraud. Declined transactions can frustrate customers and lead to lost sales for merchants.

- Cross-Border Payments: Processing international payments can be complicated due to currency conversion, regulatory differences, and higher fees.

3.6 The Future of Payment Processing

The payment processing industry is constantly evolving, driven by advancements in technology and changing consumer preferences. Here are some trends to watch:

- Real-Time Payments: Real-time payment systems, like India’s UPI and the UK’s Faster Payments, are gaining popularity for their speed and convenience.

- Blockchain Technology: Blockchain has the potential to revolutionize payment processing by enabling faster, cheaper, and more secure transactions.

- Artificial Intelligence: AI is being used to improve fraud detection, personalize customer experiences, and streamline payment processes.

- Open Banking: Open banking initiatives are making it easier for third-party providers to access financial data and offer innovative payment solutions.

Conclusion

Payment processing is the backbone of modern commerce, enabling billions of transactions every day. While it might seem complex, understanding how it works can help you make better decisions as a consumer or business owner. From authorization to settlement, every step in the payment lifecycle is designed to ensure your money moves securely and efficiently.

In the next section, we’ll explore Payment Gateways and Platforms, diving into how they work and how to choose the right one for your business. Stay tuned!