Payments Domain Journey

Welcome to the world of payments in fintech—a space where innovation meets everyday life, and where the way we move money is constantly evolving. Whether you’re swiping a card, tapping your phone, or sending money across borders with just a few clicks, the payments landscape is at the heart of how we interact with money. And let’s be honest, it’s one of the most exciting and fast-paced areas in fintech today.

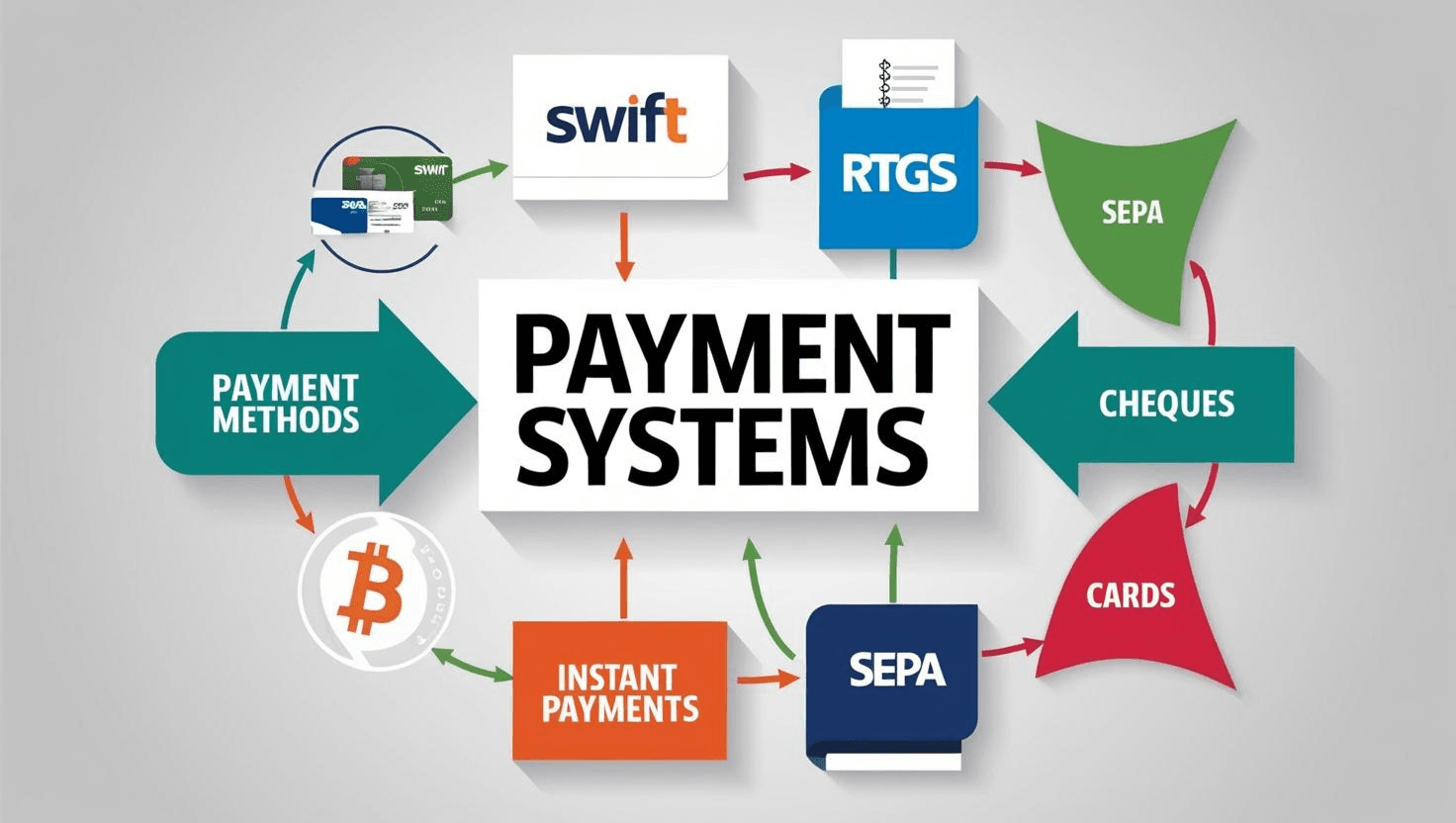

The First section is to explore what Payment Domain and system is, what are latest trends, rules, technologies involved.

- 1. Introduction to Payments Domain

- 2. Types of Payment Systems

- 3. Payment Processing Explained

- 4. Payment Gateways and Platforms

- 5. Payment Security and Compliance

- 6. Global Payment Trends

- 7. Payment Regulations and Standards: A Complete Guide for Businesses

- 8. Payment Technologies and Innovations: Shaping the Future of Transactions

- 9. Payment Challenges and Solutions: Overcoming Barriers in the Digital Age

- 10. Starting a Payment Business: A Step-by-Step Guide to Success

In this Second Section we will go more Technical. We will understand complete SWIFT standards starting with MT to ISO for all messages types in payments domain.

SWIFT – Complete Guide:

- 1. What Are SWIFT Standards Messages? Guide with Real-Life Examples

- 2. What Is MT103 SWIFT Message

- 3. Different Scenarios in MT103

- Part 1 – Question & Answers – SWIFT

- 4. MT to MX Migration for MT103 to pacs.008 Messages

- 5. What is MT202 message? Explained with Examples

- 6. MT202 to pacs.009 MX Message Conversion

- 7. SWIFT MT103 Announcement & MT202 Cover(pacs.009COV) Messages

- 8. SWIFT MT103 Returns and pacs.004 Explained

- Part 2 – SWIFT Question & Answers

- 11. Different ISO 20022 Settlement Methods – INGA, INDA, COVE, CLRG

In this Third Section we will understand complete Instant Payments System in payments domain.

Instant Payments System

- 1. Instant Payments System: Revolutionizing Real-Time Transactions in the Digital Age

- 2. Why Instant Payments Are Exploding: The 4 Key Forces Fueling the Real-Time Money Revolution

- 3. Decoding ISO 20022 Message Flows in Instant Payments: From Initiation to Settlement

But why should you care about payments domain? Well, think about it: every time you buy a coffee, split a bill with friends, or pay for a subscription service, you’re part of a massive global ecosystem that’s being reshaped by technology. From blockchain to buy-now-pay-later schemes, from digital wallets to real-time payments, the way we pay is changing faster than ever before. And with these changes come new opportunities, challenges, and questions.

In this series of blogs, we’ll dive into the trends, technologies, and stories that are shaping the future of payments. Whether you’re a fintech enthusiast, a business owner, or just someone curious about how money moves in the digital age, there’s something here for you. We’ll break down complex concepts, explore real-world use cases, and maybe even challenge a few assumptions along the way.

So, grab a cup of coffee (or tea, if that’s your thing), and let’s explore the fascinating world of payments together. Whether you’re here to learn, to stay ahead of the curve, or just to geek out about fintech, I’m glad you’re here. Let’s get started!